On April 29th, 2019, the European Commission announced that it has made the commitments offered by Mastercard and Visa legally binding. Therefore, the companies should significantly reduce (on average by around 40%) their multilateral interchange fees (MIF) for payments in the European Economic Area (EEA) with consumer cards issued elsewhere.

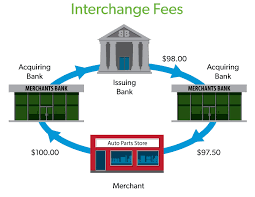

Inter-regional interchange fees are MIFs applied to payments made in the EEA with consumer debit and credit cards issued outside the EEA. In a Statement of Objections addressed to Mastercard on July 9th, 2015, and in a Supplementary Statement of Objections addressed to Visa on August 3rd, 2017, the Commission had already expressed its concerns as to the compatibility with competition rules of the inter-regional MIFs. In particular, inter-regional MIFs could increase prices for European retailers accepting payments from cards issued outside the EEA and in turn lead to higher prices for consumer goods and services in the EEA.

On December 2018, Mastercard and Visa offered commitments that would reduce the inter-regional MIFs by an average of 40%. The Commission verified whether the proposed commitments could eliminate the anticompetitive concerns raised by the MIFs. In light of the Commission’s analysis and of the results of the market test, the Commission has made those commitments legally binding on Mastercard and Visa.

Pursuant to the commitments, Mastercard and Visa undertake to:

- reduce the current level of inter-regional interchange fees to or below some agreed binding caps, which will differ depending on whether the card payments are carried out by the cardholder in a shop or for online payments;

- refrain from circumventing these caps by any measure equivalent in object or effect to inter-regional MIFs;

- publish all inter-regional interchange fees covered by the commitments in a clearly visible manner on their respective websites.

The commitments, which will apply for five years and six months, cover inter-regional interchange fees applied to payments made with the Mastercard, Maestro, Visa, Visa Electron and V-PAY credit and debit card brands. According to the Commission, these measures will significantly reduce the costs for retailers in the EEA when they accept payments made with cards issued outside the EEA. This is expected to lead to lower prices to the benefit of all European consumers.